De acuerdo con el artículo 4 de la

Ley 25/2013, de 27 de diciembre, de impulso de la factura electrónica y creación del registro contable de facturas en el Sector Público, publicada en el BOE el 28 de diciembre de 2013, es previsible y deseable que ya en 2014 se produzca una notable incorporación de la factura electrónica en el marco de las relaciones jurídicas entre proveedores de bienes y servicios y las distintas entidades de la Administración pública estatal, hasta llegar al uso obligatorio de la factura electrónica, en el ámbito indicado en el proyecto de ley, el 15 de Enero de 2015.

This appearance of the electronic invoice should be accompanied by changes in the processing of expenditure dossiers, replacing traditional processing of paper documents signed by hand with electronic documents bearing a recognised electronic signature, and traditional means of transport of documents by remote data transfer.

In the area of the General State Administration, the accounting obligation acknowledgement document (or its equivalent in the case of bodies adhering to the accounting information system SIC’3) will require the identification codes of all justification documents not exempt from entry in the accounting register of invoices to be entered in the register. The accounting system will confirm that the amount in the document is greater than or equal to the sum of the amounts in the invoices identified in the accounting document.

The processing of paper invoices in expenditure dossiers does not change with respect to the current situation due to the introduction of the accounting register of invoices except for the fact that the obligation acknowledgement accounting document will identify the associated invoice or invoices through the corresponding accounting registration codes for invoices, as indicated in the previous paragraph.

In the case of electronic invoices, when the organisation is subject to a prior audit system, an expenditure dossier that contains at least one electronic document must be sent with all other invoices to the monitoring body by the processing unit of the management body competent to approve the dossier either manually using the IRIS platform for dispatch to the State Controller or, if the unit has a management system such as SOROLLA2, automatically from the management system, using the IRIS web service provided by the management centre.

Provision is made for the processing of mixed dossiers: that is, those consisting of paper documents (for example, obligation acknowledgements) and electronic documents (for example, electronic invoices). The sending of the electronic documents from these dossiers by the processing unit to the monitoring body will be carried out via the IRIS platform for dispatches or the associated web services, as indicated in section 5 of the Decision of the State Controller’s Office dated 28 November 2005, approving the IRIS application. To do this “the processing unit must list all documents making up the dossier, indicating whether they are being sent electronically or on paper, in accordance with the provisions of section 2 of article 13 of Royal Decree 2188/1995. Once they have been sent, the application shall return a receipt with a list of the documents in the dossier and the identification assigned to them. This will be accompanied by any paper documents forming part of the dossier”.

Both Royal Decree 2188/1995, dated 28 December, developing the internal monitoring system implemented by the State Controller’s Office and the State Controller’s Office Decision of 28 November 2005, approving the IRIS application, govern the fundamental aspects of electronic auditing.

The following considerations could be highlighted as a summary of the conditions and restrictions on the computer processing of expenditure dossiers and their auditing by electronic means:

Conditions:

- The electronic documents forming part of the original dossier will have the same value as paper ones when they include their author’s recognised electronic signature (art. 13. 1 RD 2188/1995).

- When the proposal and the act or decision subject to auditing are formalised in an electronic document, the result of the audit will also be formalised in an electronic document incorporating the recognised electronic signature of the competent auditor (art. 13 bis. 1 RD 2188/1995).

- The electronic signature format will meet the standard ETSI 101 903.

Restrictions:

- If electronic receipt → Electronic accounting document.

- Electronic accounting document only if one of the documents in the dossier was electronic.

- If accounting document is used as a receipt for the administrative act → The accounting document batch procedure cannot be used.

- The accounting document batch procedure may only be used with authorisation from the State Controller’s Office after prior request by the auditor.

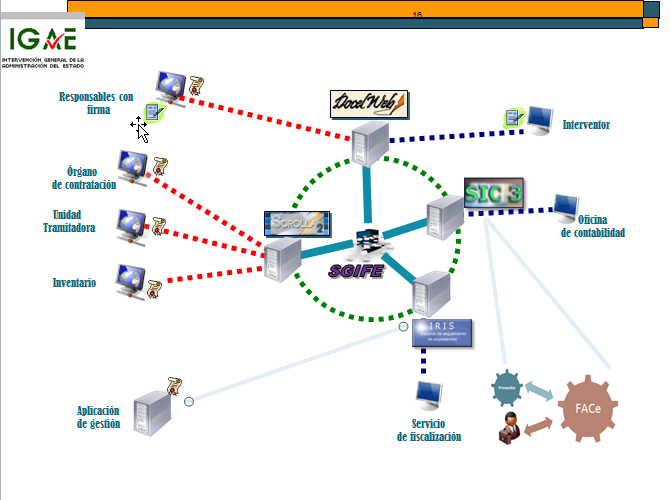

The following diagram shows the different agents and information systems involved in the electronic processing of expenditure dossiers in the General State Administration and its public bodies.

The result of the audit will be made available to the management body via the IRIS despatch platform (e-mail notification) if the dossier has been sent via this platform or automatically sent to the processing unit’s management system if, as is the case with SOROLLA2, this system uses the web services provided for the purpose by the State Controller’s Office.

Once the dossier has been audited by the control body and approved by the corresponding management body, the management body’s processing unit will send the accounting document, accompanied by the expenditure receipts, to the accounts office. If there are any electronic documents among the documents to be sent, they will be sent, as in the above case, either manually via the State Controller’s Office’s IRIS despatch system or, if a management system like SOROLLA2 is available, automatically from the management system using the IRIS web services. In this respect it must be pointed out that, if any of the receipts is electronic (on this point remember that the invoices form part of the expenditure dossier but do not justify the accounting documents), the accounting document issued by the processing unit should be an electronic accounting document of the kind established in section four of the State Controller’s Office’s Decision of 28 November 2005, regulating the procedures for processing accounting document files, in accordance with the provisions of section three, point 2: The processing of electronic accounting documents shall be compulsory provided that one of the receipts associated with these documents is also electronic.

Concerning the accounting document, it should be highlighted that, in accordance with the amendment to be introduced into the Order approving the accounting documents to be used by the General State Administration, it will not be permitted to include invoices noted in the accounting register of invoices and others that have not been noted in the register in the same accounting document. That means separate accounting documents will have to be drawn up for invoices noted in the accounting register of invoices and those not noted in it, so that the SIC’3 accounting information system can carry out the appropriate confirmations in the former case.

Conviene destacar en este punto que el impulso de la factura electrónica en los procesos de contratación de la Administración, sería lógico que fuera acompañado de un impulso equivalente de los propios órganos gestores al objeto de evitar los expedientes mixtos (con documentación en papel además de la electrónica) para simplificar la tramitación administrativa. Se trata por tanto de propiciar el paso a expedientes electrónicos, de forma que toda la documentación del mismo, especialmente la generada por la propia Administración (memorias justificativas, pliegos, propuestas de autorización, compromiso o reconocimiento de la obligación, documentos contables,…) sea electrónica.

Concerning the accounting document, it should be highlighted that, in accordance with the amendment to be introduced into the Order approving the accounting documents to be used by the General State Administration, it will not be permitted to include invoices noted in the accounting register of invoices and others that have not been noted in the register in the same accounting document. That means separate accounting documents will have to be drawn up for invoices noted in the accounting register of invoices and those not noted in it, so that the SIC’3 accounting information system can carry out the appropriate confirmations in the former case.

The State Controller’s Office will offer management centres and processing units using the management systems it provides the use of the corporate DocelWeb electronic signature folder, which includes a service for the storage and custody of electronically signed electronic documents (SGIFE). A request for access to this system, like the other systems provided by the budgetary administration, may be made via the virtual office on the budgetary administration website (www.pap.hacienda.gob.es), using the “Application for access to systems” section.