As established in article 3 of the Promotion of Electronic Invoicing and Creation of a Public Sector Accounting Register of Invoices Act 25/2013, dated 27 December, published in the BOE on 28 December 2013, the supplier that has issued the electronic or paper invoice for the service provided or goods supplied to any public administration will, for the purposes of this Act, be obliged to present it to an administrative register under the terms established in article 38 of the Public Administrations Legal System and Common Administrative Procedure Act 30/1992, dated 26 November, within a period of thirty days from the actual date of delivery of the goods or provision of services.

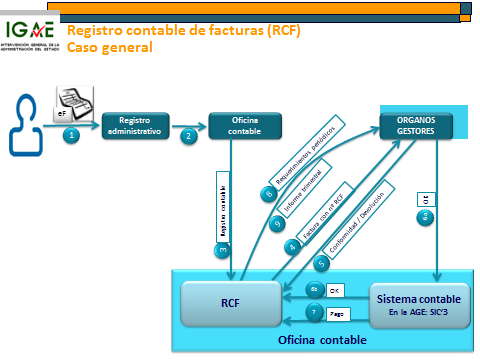

The following diagram explains the complete flow of invoices through the accounting register of invoices, as established in the Bill to encourage electronic invoicing and create an accounting register of invoices in the public sector and in the draft Order regulating the functional and technical requirements of the accounting register of invoices.

(1) The supplier issuing the invoice will present it to an administrative register. If it is an electronic invoice, the supplier will present it via the general entry point for electronic invoices corresponding to the public administration, which will be connected to an electronic administrative register in which the corresponding register entry will be made. In both cases, electronic or paper invoices, the administrative register (not to be confused with the accounting register of invoices) will generate the corresponding receipt.

(2) The administrative register where the invoice is received will immediately send it to the competent accounts office so it can be noted in the accounting register of invoices. For electronic invoices, this process will be carried out electronically. The electronic invoices presented at the corresponding general entry point for electronic invoices will be made available or sent electronically via an automatic service provided for this point, to the corresponding accounting register of invoices depending on the accounts office appearing on the invoice.

(3) The noting of the invoice in the accounting register of invoices will give rise to the assignment of the corresponding identification code in the accounting register, which will accompany it as it is processed. In the case of electronic invoices, this code will be notified to the general entry point for electronic invoices.

(4) The accounts office that has noted the electronic or paper invoice received in the respective accounting register of invoices will send it to the recipient management body via the corresponding processing unit, noting the date and time of receipt by the processing unit in the accounting register of invoices. The recipient will have to either accept or return the invoice it has received, and this decision will also be recorded in the register. In the case of electronic invoices, the accounting register of invoices will make the invoices available to the corresponding processing units which, if they have a financial/budgetary management system suitable for the purpose, will receive them in this system using the services provided by the accounting register of invoices for such a purpose.

(5) Acceptance/Return: The processing unit receiving the invoice will express its acceptance or rejection of it either by directly accessing the corresponding accounting register or via its own management system. In the latter case, it may make use of the services established for the purpose by the accounting register of invoices.

(6) If the invoice is accepted, the processing of the recognition by the management body and the accounting entry of the obligation recognised and the payment proposal will identify the invoices covered by the proposal via the corresponding identification codes assigned in the accounting register of invoices. The accounting entry of the obligation recognised in the accounting information system will automatically lead to a change in the invoice’s status in the accounting registry of invoices, moving to “acknowledged” status.

(7) The noting in the accounting information system of the actual payment of the corresponding operation will also automatically lead to a change in the invoice’s status in the accounting registry of invoices, moving to “paid” status.

(8) The accounts office, via the accounting register of invoices, will make periodic requirements for action with respect to invoices awaiting obligation acknowledgement, which will be sent to the competent management bodies

(9) The accounts office, via the accounting register of invoices, will draw up a quarterly report in relation to the invoices for which more than three months have elapsed since they were noted and for which the obligation has not been acknowledged by the competent bodies. This report will be sent to the internal monitoring body within the fifteen days following the end of each natural quarter of the year.